by Justin Dove, Investment U Executive Editor

Tuesday, May 8, 2012: Issue #1768

Not many markets have been written off by investors more than uranium since last March.

Understandably, the Fukushima incident left a bad taste in everyone?s mouth. Countries such as Germany and Japan claim they?re done with nuclear power altogether.

But surprisingly there?s been a buzz recently in my inbox about a potential rebound in the uranium market.

My interest was piqued, but I wanted to dig a little deeper into the story. So I dialed up two of the smartest people I know on the subject to get their take ? Global Resource Investments CEO and legendary contrarian Rick Rule and Investment U?s own commodity and resource expert Matthew Carr.

And after talking to them, it?s my belief that we?re finally at a bottom in the uranium market. There?s even reason to believe in a potential double over the next two years.

Below I?ll discuss an easy way to capitalize on the rebound. But first I?ll share what I learned about the uranium market from Matt and Rick.

Matthew Carr: ?A Potential Double in Two Years?

?Few people are excited about uranium right now. And that?s understandable after the Fukushima disaster last year,? Matt told me. ?It jolted the entire uranium market. Here?s the thing though: You can earn yourself a double investing now in uranium. But it?s not going to be overnight.?

Matt told me he sees Japan using more LNG for the near future. And for him it?s too early to tell if Japan will ever go back to nuclear. But he obviously sees strength in the uranium market over the long term.

?Fact is, there?s a supply deficit coming. We?re going to go from $52 a pound to $70 and $80. A lot of people aren?t going to jump in until we hit $70? That?s silly,? he said. ?Ultimately, I think two years from now ? and maybe sooner if the market heats up quicker than expected ? you?ll pat yourself on the back for acting on this one. It?s just a game of patience. Bide your time. Build your positions. The price of uranium will continue to slowly tick higher, and so will uranium stocks.?

And when I contacted Rick, I heard more of the same?

Rick Rule: ?Uranium Will Be With Us for Some Time?

?As a consequence of the disaster in Japan, the uranium industry got really, really, really trounced,? he told me. ?There has been a snap-back in the uranium industry, but I think it has some to go.?

It was easy for me to understand that poor public perception hurt the demand for nuclear power and ultimately uranium. But I didn?t even think about the supply side of the equation. After all, Japan had to do something with all that extra uranium it had lying around?

?It?s worthy to note that the spot price of uranium has fallen from about $70 to $52,? Rick said. ?That?s solely as a consequence of the Japanese selling on the spot market uranium that they previously had in inventory.?

But despite the negative public perception and news that countries like Germany are discarding nuclear altogether, Rick doesn?t see it going anywhere for some time?

?The world is also saying, as a consequence of Fukushima, that we need to rely less and less on nuclear power. But that isn?t what?s happening on the ground,? he said. ?Many parts of the world, including ironically Japan, are or will be investing heavily in nuclear power on a going forward basis for a very simple reason ? when people hit a switch they want the lights to go on. Without nuclear power in some places, it doesn?t happen.?

For places like Japan, Korea, Taiwan, or Singapore, to name a few, there are truly limited options. These densely populated areas have high energy consumption with limited natural resources. So according to Rick, fuel density is crucial for fuel security.

?In Japan they can and do store five or six years of uranium. That?s because in the face of something like the Arab oil embargo that happened in 1973, they?re bulletproof,? he said. ?There is no other energy source that a place like Korea or Taiwan or Japan can store like that. Imagine trying to store six years? worth of hydroelectric, it doesn?t work. Imagine trying to store coal or natural gas or oil. The density of uranium lends it to very, very, very secure base load power. And as a consequence of that, uranium will be with us for some time.?

And the facts seem to support Rick?s observations. The United States and Europe may be shunning nuclear power, but not the rest of the world. According to the World Nuclear Association, 60 nuclear plants are currently under construction, 150 are in the works and 340 are in various stages of proposal.

And although it?s hard to imagine Japan going back to nuclear anytime soon, there are some interesting reasons to think they may eventually go back to more nuclear power.

According to figures from the Japanese Atomic Industry Forum, Japan faces a 12% shortage of electricity this summer. Meanwhile additional fossil fuel imports are costing it about $40 billion ? or $333 per person, per year ? while its carbon emissions are roughly 14% above 1990 levels.

An Easy Way to Play

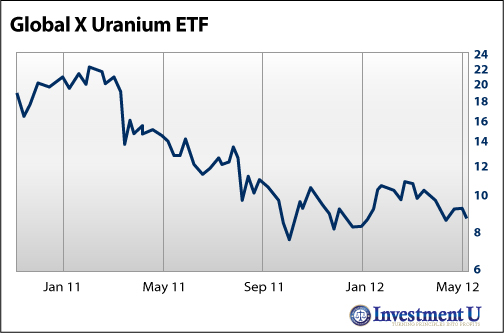

Looking at the graph below, you can see the Global X Uranium ETF (NYSE: URA) was trading in the $20 range just before Fukushima. Since then, it?s been on a fairly steady decline, currently trading around $8.50 a share?

The main holding, about 20%, for URA is the largest pure play in uranium mining, Cameco Corp. (NYSE: CCJ). But Global X adds some diversification for U.S. investors with some smaller miners that are only traded on the TSX.

Keep in mind that URA is a completely speculative recommendation. You shouldn?t invest any more than 1% of your portfolio and we always recommend a 25% trailing stop with any investment.

But if you share my view after hearing what some industry heavy hitters are saying, you?ll want to take a long look at this and other individual uranium plays.

Good Investing,

Justin Dove

VN:F [1.9.16_1159]

Rating: 0.0/5 (0 votes cast)

chardon high school christopher plummer viola davis school shooting in ohio shooting at chardon high school sasha baron cohen stacy keibler

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.